The Time Traveler's Investment Calculator

The Time Traveler’s Investment Calculator is a product of MeasuringWorth.com.

We all know that we need to save for our future, but how? Stocks, Gold, Housing, Bonds? Which is best? There is no way to know the future, but this calculator will tell you what was the best in the past.

Do you sometimes wish you could have a time machine and change your investment strategy? Wouldn’t you like to be able to go back and tell a grandparent to make an investment in your name for you to cash in today?

Do you realize if someone had put a dollar in the stock market in 1871 and left it there, that investment would be worth about $180,000 today? In 2007, it would have been worth only a little less at $121,000, but two years later in 2009, it would have been worth only $77,500. The most brilliant traveler would have put a dollar in the stock market in 1871 and then moved it all the gold in 2000 and then back to stocks on 2012. That person would have close to $960,000 today. Hindsight is great.

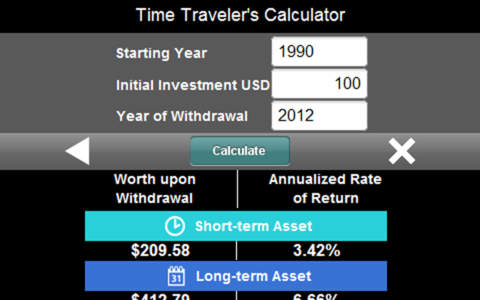

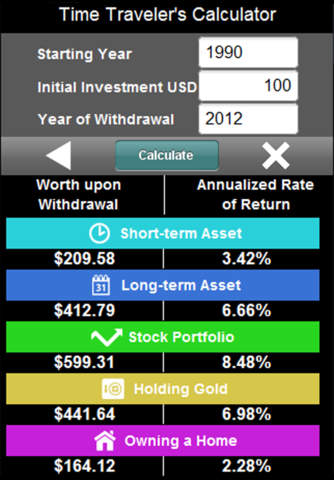

The Time Traveler’s Investment Calculator is a simple way to go back in time and choose a hypothetical investment strategy and see how you would have done. You can compare your actual investments with what you wish you had done. Was gold, housing or the stock market the best investment? Check it out. See what fun you can have in out guessing the experts. Historical Novelists can make sure their characters made the right or wrong decisions to fit their plots.

For you Gold Bugs, the last decade and the 1970s beat all alternates. Tell your broker if you had put your money in gold in 2000 instead of the stock market you would have had five times as much money by 2011. But be careful, during the decades of the 1980s and 1990s, an investment in the stock market out performed gold by a factor of seven!

What about housing?

Between 2000 and 2006, investing in a house paid an 11% annualized return. Only gold paid more at 13.7%. Since 2006, there has been a drop of 33% in housing values, with a small recovery starting in 2013. But back in the 1980s, owning a house was almost three times better than holding gold and in the 1970s, owning a home was a better investment than the stock market.

The return on long and short-term assets differ more, the longer the period.

A dollar left in a short-term assets starting in 1871 would be worth $67.10 by 2014. In a long-term asset it would be worth up to $2,000 or more, depending on the terms.

You can ask all these questions and more on this calculator.

This calculator is sponsored by the supporters of MeasuringWorth. You can be one too by going to our Donate page.